VA Funding Fee Chart - VA Funding Fee Calculator & More!

Va Loans

REAL ESTATE FOR VETERANS

Peter Van Brady

Founder of SoCal VA Homes

Author: Avoiding Mistakes & Crushing Your Deals Using Your VA Loan

What is the VA Funding Fee?

VA home loans offer an affordable way for Veterans and their families to buy homes. While most VA loans don’t require any money for a down payment, nor any closing costs, buyers are expected to pay a VA home loan funding fee. But what is the funding fee for a VA loan, exactly?

Read on to learn all about the VA loan funding fee, how it works, how much you can expect to pay, and answers to other frequently asked questions.

What is a VA Funding Fee for a VA Loan?

The funding fee is a one-time fee equal to a percentage of the mortgage loan amount. It’s paid to the Department of Veterans Affairs (VA) and is due at the close of escrow. It can be paid all at once in cash or financed as part of the mortgage loan.

Why do you have to pay this fee? VA loan funding fees have a very specific purpose. They fund the VA loan program by essentially providing an “insurance policy” to the lender, protecting them from losses. They also ensure that the loan guaranty program will continue to be an option for millions of military families for generations to come.

How Much is the VA Funding Fee?

The VA funding fee percentage you’ll need to pay depends on your situation and currently ranges from 1.40% to 3.60% of a home’s purchase price. Learn more by reviewing the VA funding fee table below. Plus, calculate yours using our VA funding fee calculator.

VA Funding Fee Calculator

VA Funding Fee Chart 2020 - 2022

How much is the funding fee for a VA loan in your situation? It can vary based on factors, including:

- Your loan amount

- Loan type (Purchase or Refinance)

- Type of service (Active Duty/Retired/Guard/Reserve)

- Down payment (if any)

- Prior VA use

The VA funding fee table below breaks down how the fee amount varies based on different factors.

Purchase - VA First Time Use Funding Fee

Down Payment

- 0% Down

- 5% - 10% Down

- 10% or More Down

Active Duty / Retired

- 2.30%

- 1.65%

- 1.40%

Guard / Reserve

- 2.30%

- 1.65%

- 1.40%

Purchase - VA Funding Fee Subsequent Use

Down Payment

- 0% Down

- 5% - 10% Down

- 10% or More Down

Active Duty / Retired

- 3.60%

- 1.65%

- 1.40%

Guard / Reserve

- 3.60%

- 1.65%

- 1.40%

VA Cash Out Refinance Funding Fee

- 1st Time Use (non-VA to VA)

- Additional Use (VA to VA)

Active Duty / Retired

- 2.30%

- 3.60%

Guard / Reserve

- 2.30%

- 3.60%

VA IRRRL Funding Fee (Interest Rate Reduction Refinance Loan)

- 1st Time Use

- Additional Use

Active Duty / Retired

- 0.50%

- 0.50%

Guard / Reserve

- 0.50%

- 0.50%

Does The VA Funding Fee Change Each Year?

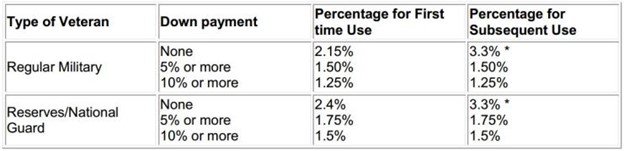

The VA mortgage funding fee doesn’t change every year but it has changed over time. When looking back to 2015, for example, the rates were lower.

VA Funding Fee table 2015:

As you can see from the VA Funding Fee table from 2015 above, compared to chart below, the 2020 VA funding fee increased when compared to previous years. Here’s a look at the fee for first time use with 0% down over time.

Historic VA First Time Use Funding Fee with 0% Down

- VA funding fee 2015: 2.15%

- VA funding fee 2016: 2.15%

- VA funding fee 2017: 2.15%

- VA funding fee 2018: 2.15%

- VA funding fee 2019: 2.15%

- VA funding fee 2020: 2.30%

- VA funding fee 2021: 2.30%

Changes occurred due to the Blue Water Navy Vietnam Veterans Act of 2019 which went into effect in January of 2020. The VA funding fee table 2020 brought the rates up to where they are now. So what all changed?

The 2020 VA funding fee changes included the following:

- VA funding fee first time use: From 2.15% to 2.30% with 0%

- VA funding fee subsequent use: From 3.30% to 3.60% with 0% down

- VA funding fee refinance: Same as purchase rates for no down payment.

As of the latest news, the VA funding fee 2020 chart will apply for 2022 and beyond.

Frequently asked questions:

What was the VA funding fee for 2019?

For regular military members with no down payment, it was 2.15% for first time use and 3.30% for subsequent use.

What is the VA funding fee for 2020 and beyond?

For regular military members with no down payment, the VA loan funding fee in 2020 was 2.30% for first time use and 3.60% for subsequent use. See more details in the tables above.

Do All VA Loans Have a Funding Fee?

VA loans come with the VA upfront funding fee unless you qualify for an exemption. For example, many wonder if there is a VA funding fee for disabled vets. Below, find a list of the qualifying exemptions.

Who is Exempt from Paying the VA Funding Fee?

Borrowers can get a VA loan funding fee exemption under certain circumstances, such as if a veteran has service-related disabilities or if the spouse of a deceased veteran is applying and the veteran died in service or from a service-related disability. Here’s a closer look at the various exemptions.

VA Funding Fee Exemptions

You may be able to receive a VA loan funding fee exemption (aka VA funding fee waiver) if you are in any of the following situations:

- You are receiving VA disability compensation for a service-connected disability*

- You are eligible to receive VA compensation for a service-connected disability, but you’re receiving retirement or active-duty pay instead.

- You are the surviving spouse of a Veteran who died in service or from a service-connected disability, or who was totally disabled, and you're receiving Dependency and Indemnity Compensation (DIC).

- You are a service member with a proposed or memorandum rating, before the loan closing date, saying you're eligible to get compensation because of a pre-discharge claim.

- You are a service member on active duty who before or on the loan closing date provides evidence of having received the Purple Heart.

*We have seen one exception to this nearly obvious indicator that a Veteran "should be eligible." A client was receiving VA Disability pay from a 10% rating. This serviceman was injured during boot camp and was discharged before 90 days of active service - a requirement for eligibility in a time of war. He still was awarded disability compensation but was not eligible to utilize a VA loan - a rarity.

Should the VA funding fee be waived with 10% disability? Yes, borrowers and homeowners with a disability rating of at least 10% will typically be exempt from paying the funding fee.

If you have any questions about the VA funding fee exemption, the team at SoCal VA Homes can help you get answers and determine if you are eligible.

How to Apply for a VA Funding Fee Exemption?

Instead of a VA funding fee exemption form, you’ll fill out the Verification of VA Benefits (VA Form 26-8937) which is used to determine your eligibility. If an exemption is approved due to a service-connected disability, you’ll send your funding fee receipt to the VA along with VA-Form 26-1820 (Report and Certification of Loan Disbursement).

It is very important to know that funding fee exemptions are not automatic and that you have to apply for them. Your lender can help you obtain your Certificate of Eligibility and other forms used by the VA to make determinations about exemptions and the final funding fee amount.

Is the VA Funding Fee Part of Closing Costs?

The term “closing costs” refers to the fees associated with finalizing a home loan. For VA home loans, the funding fee is generally rolled into the loan amount, which allows for truly zero closing costs. There is flexibility, though, with how it is paid. Some opt to pay the entirety of the VA home loan funding fee when they close on their house, which would make it a part of the closing costs.

How to Calculate a VA Funding Fee

A few factors go into calculating the VA funding fee. Since the 2019 Navy Blue Water Bill was passed, the funding fee is:

- 2.30% for military borrowers who do not make a down payment and are using their benefit for the first time.

- Buyers who make down payments between 5.0% - 9.99% will pay a funding fee of 1.65%.

- The funding fee is 1.40% for those who make a down payment of 10% or higher.

- You are a service member with a proposed or memorandum rating, before the loan closing date, saying you're eligible to get compensation because of a pre-discharge claim.

- Fees for a first-time VA purchase are also lower. Borrowers making a second VA-backed purchase pay the higher subsequent use funding fee VA of 3.6%.

National Guard and Reserve members pay slightly higher funding fees than those in other branches of the military. Our VA loan calculator with funding fee estimations can help you figure out how much you will owe towards your fee.

Can You Get a VA Funding Fee Refund?

There are some circumstances where you may be able to get a VA funding fee refund. The most common case is when a VA funding fee disability waiver comes in after closing. If a Veteran pays the funding fee, and then retroactively becomes eligible for an exemption, they can request a refund.

Note: The effective date of your VA compensation must be retroactive before the date of your loan’s closing.

If you believe you should’ve received a VA funding fee refund after closing but haven’t, contact our team today.

Can The VA Funding Fee Be Financed?

The VA funding fee doesn't need to be 'paid' separately and is typically rolled into the loan. This is a big benefit to borrowers looking to take advantage of the $0 down benefit of the VA loan. Not only do borrowers not need to put anything down, but they can also finance the VA funding fee.

Is the VA Funding Fee Tax Deductible?

Can you deduct the VA funding fee from taxes? In most cases, it is tax-deductible. Borrowers can deduct the amount they pay toward the funding fee each year. This means that if you pay the whole funding fee upfront, you can deduct the entire fee from your taxes that year. On the other hand, if you roll the fee into your loan amount, you’ll only be able to deduct the portion of the fee that you’ve paid during the year.

Whether you pay the funding fee upfront or roll it into your loan, the entire funding fee can still be deducted. It’s simply a matter of claiming the whole deduction in the first year versus claiming smaller deductions every year until the loan is paid off. In any case, be sure to consult with a tax professional or the IRS to determine if you can deduct the VA funding fee from your taxes.

FHA UFMIP vs VA Funding Fee

You may hear different terms like FHA loan, VA loan, PMI, MIP, funding fee, and UFMIP thrown around when looking at government-backed mortgage programs. Here’s a quick overview to help clear up the confusion between the FHA loan’s private mortgage insurance and the VA funding fee.

Home loans through the Federal Housing Administration (FHA) program require borrowers to pay an Up Front Mortgage Insurance Premium (UFMIP). It’s a lump sum that can be financed into your loan but helps to protect the lender in case you default. The reason it’s required is that the FHA program has lenient down payment and eligibility requirements which increase the risk for the lenders.

VA loans don’t require you to pay mortgage insurance but do require payment of the funding fee. VA funding fees are similar to UFMIP in that they are both lump-sum amounts that can be rolled into the loan at closing. However, the VA funding fee is paid to the VA while the UFMIP is for insurance that protects the FHA-approved lender. Mortgage insurance is not required on VA loans.

Did 2020 Change Everything About VA Loans?

Much changed during 2020 with VA loans as that’s when the rate increases went into effect. However, the following aspects of VA loans were not impacted:

- VA IRRRL funding fee 2020: Unchanged (0.50%)

- VA funding fee tax deductible 2020: Unchanged (Still deductible)

- VA funding fee exemption 2020: Unchanged (Same exemptions apply)

Should you expect the VA funding fee chart 2021 to change in the coming years? We’ll keep you posted!

Contact Us Today!

If you have more questions about VA home loan funding fees, we’re here to help! We are a team of military Veteran real estate agents and Sr. VA loan pros, who choose only to help Veterans achieve homeownership. We invite you to browse our listing of VA approved homes for sale in California. Call us today at 949-268-7742.

As Seen on ABC 10 5:00 O’Clock News