VA Loan Rates vs. FHA Loan Rates

Va Loans

REAL ESTATE FOR VETERANS

VA Loan Rates Versus FHA Loan Rates: Which are Better?

Getting a mortgage with a low-interest rate can save you thousands of dollars over the life of your loan. Both VA and FHA loans are known for offering competitive interest rates and are great options for first-time homebuyers. But which one is better for you? To help you decide, here’s a look at the differences between the two programs and a comparison of VA loan rates versus FHA loan rates.

VA loan rates versus FHA loan rates: Which are lower?

The interest rate you can get depends on a number of factors, including the current market conditions, your income, and your credit score. But generally, you’ll be able to get just a slightly better interest rate by going with an FHA loan rather than a VA loan. The difference is about 0.25% in fee, which equals about one-sixteenth (0.0625) in rate, so you probably won’t even notice unless you ask an experienced loan officer for the nitty-gritty details regarding the rate comparison.

However, the big advantage of a VA loan vs an FHA loan is the comparison of fees is that you’ll pay less every month with a VA loan because it doesn’t have the monthly mortgage insurance premiums.

What is the difference between FHA and VA loan programs?

Before you decide which program is right for you, there are a few key differences between FHA and VA loans that you should know about.

Down payment

FHA loans require a minimum down payment of 3.5%. VA loans, on the other hand, don’t require a down payment, which makes them a better option for buyers with minimal savings.

Property type

Both FHA and VA loans can only be used to purchase primary residences, not vacation homes or rental properties. However, you may be able to use a VA or FHA loan to buy a multi-family home if you plan to live in one of the units.

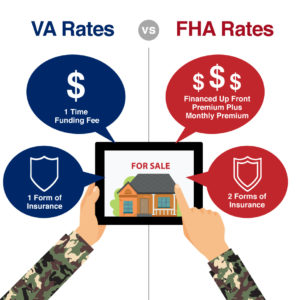

Mortgage insurance

FHA loans require you to pay annual mortgage insurance premiums, which are usually 0.85% of the loan balance, paid monthly.

If you get a VA loan, you won’t have to pay any mortgage insurance.

Upfront fees

With an FHA loan, you’ll have to pay an upfront premium at closing that’s equal to 1.75% of your total loan amount.

When you close on your VA loan, you’ll be responsible for negotiating closing costs to be paid by the seller or lender or pay for your closing costs. The closing costs include a VA funding fee that’s equal to 2.30% of your loan amount for first-time users of their VA loan benefit.

With an FHA loan, you’ll have to pay upfront mortgage insurance and closing costs, which are typically 3% to 4% of the total loan amount.

Approval requirements

Both FHA and VA loans have debt-to-income ratio and credit score requirements that you’ll need to meet in order to qualify.

The FHA requires borrowers to have a credit score of at least 500 and a debt-to-income ratio of 43% to be approved for a loan.

The VA doesn’t set a minimum credit score, but many lenders require borrowers to have a score of 620 or higher. You’ll also need to have a debt-to-income ratio of 41%, although many lenders accept higher ratios. You will also need to meet the military service requirements.

Which loan type is best for you?

FHA loans are worth considering. However, VA loans are a great option for military service members. They offer low interest rates, low fees, and the option to put no money down. But if your credit is well below-average and you’re having trouble getting approved for a VA loan, consider FHA as well. They are far more flexible and affordable than conventional loans.

Call 949-268-7742 to speak with one of our experienced VA loan professionals at SoCal VA Homes today! Discover if the VA loan is the right choice for you.

As Seen on ABC 10 5:00 O’Clock News