How We Are Different

Get THE PLAN to Buy a Home

Start Today and Finish with the Keys in Your Hand!

“We Are Veterans Helping Veterans with Unique & Powerful Programs Creating EASIER, BETTER Ways to Buy a Home Using Your VA Loan."

Whether you’re keenly aware of your local real estate market conditions and how to best utilize your VA home loan benefit, or you are just beginning, this is for you. Reading this…discovering this may be a huge win for you and your family. Disregarding all this could result in a failure altogether in your home buying efforts.

If you prefer, here’s a 5 minute video that tells the whole story…->

It’s a fact that trying to buy a house using your VA loan in ANY market presents UNIQUE HURDLES. Be prepared to confront and somehow overcome The SELLER’s bias against you:

With Multiple Offers, Sellers Are Hesitant to Accept Your VA Offer Because…

- Sellers prefer the “substance” and speed to close of an all-cash offer – no appraisals or financing to obstruct the closing. They prefer a thick & juicy conventional offer vs. a VA buyer with no “skin in the game.” VA zero down and closing costs negotiated to zero represent a limited commitment in the seller’s eyes.

- Sellers prefer the strong commitment of LARGE earnest money (Good Faith) escrow deposits from all-cash buyers and juicy conventional offers. VA buyers tend to offer slim earnest money deposits to escrow – smaller commitment.

- Sellers are resistant to the longer escrow terms typically written into a VA purchase contract vs. the alternative quick-close escrows of an all-cash buyer or the more rapid escrows common to conventional buyers.

- Sellers don’t like the “VA non-allowable” closing costs that must either be paid for by the lender or paid for by the seller, thereby increasing the seller’s closing costs.

- Sellers don’t care for the stringent inspection standards required and conservative valuation results produced by the VA appraisers. This is in contrast to no appraisal required from an all-cash buyer or a different type of appraisal (not VA approved) produced for a conventional buyer.

You want a roof over your head…for you and your family…a place to call home. To win this fight, to cut down The Seller’s barriers and get the focus of their attention, you must start by being AWARE of your challenges. The Seller has power to reject you…to make you feel inadequate and unworthy. For ill-prepared and ill-equipped VA home buyers, the increasing frustration of repeated rejections from Sellers can produce “buyers fatigue,” exhaustion and even spell outright failure.

You served your country. At some level, you made sacrifices. Perhaps you have made SIGNIFICANT sacrifices that altered the course of your life forever. So why NOW are you treated as a second class citizen? WHY are the sellers inclined to view you at some level as inferior or insufficient? In this day and age…REALLY?

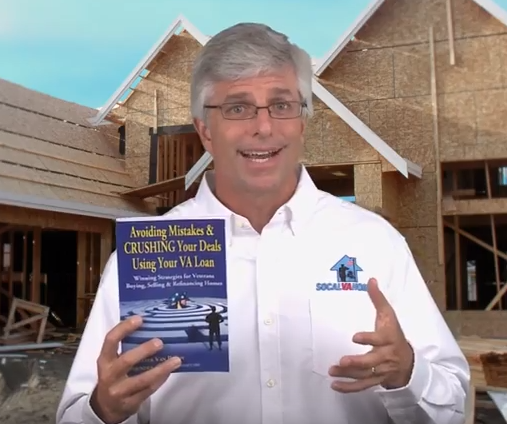

My name is Peter Van Brady, and I’m deeply DRIVEN by this obstacle…this market injustice against you . Our men and women who CHOSE to serve deserve better…YOU deserve more.

I invested three and ½ years, time away from my wife Nancy and my three kids, to write my book, Avoiding Mistakes & CRUSHING Your Deals Using Your VA Loan. That investment of time resulted in the #1 book on Amazon helping Veterans buy, sell & refinance their homes using their VA loan.

Since 1992, more than half of my real estate & lending career has been exclusively devoted to solving problems for active military and Veterans. Many of my Veteran clients have told their colorful stories in their video reviews on this website. Also on our reviews page on this site, you’ll find a cool tool that shows a partial list of our VA clients: a California map showing 417 names, addresses, loan amounts and closing dates (all of public record). I’ll bet you know someone on this map!

Our Process, The Plan

To win this battle and to get the home that you really want, you must equip yourself with a plan that utilizesstrategies and tactics – TOOLS – that will effectively overcome any level of the seller’s resistance and bias against your VA offer.My team will introduce you to, then walk you through The Plan – a 3 step process of education, preparation and execution. With The Plan to “Get The Sellerto Say Yes” to the home you really want, you will utilize one of our…

3 Breakthrough Programs to Transform Your Home Buying Experience and Result – to Get The Home You Really Want Using Your VA Home Loan

Don’t hesitate. I challenge you right now to take the first small step now to begin your journey to getting the home you really want. Request a copy of The Plan to “Get The Seller to Say Yes” now.

At no cost to you, here’s what you will receive in The Plan:

- Our simple and easy 3 step process: Start by receiving The Plan today and finishing by Getting the Seller to Say Yes and moving into the home you really want!

- Our SoCalVAHomes Value Guarantees – Our Core Values & ironclad promises to you!

- Your “Needs & Wants Wish List”: We’re listening…tell us EXACTLY what you need & want in your new home – everything!

- VA Home Buyer’s document checklist: These are the items you’ll need to share with us to achieve your VA Loan Pre-Approval!

- A “one-on-one” phone (or in person) consultation: An in-depth education about how we use the strategies, tactics & trade secrets of The Dreamweaver Home Purchase Process and The Veteran’s Angel Program to transform your home buying experience and result.

- Top 5 Mistakes VA Home Buyers Make – Quickly and Easily Take Action Steps to Get Well-Prepared! Don’t just survive the home buying process using your VA loan…Crush it! THRIVE!

- Copy of Amazon’s #1 VA Book: Avoiding Mistakes & CRUSHING Your Deals Using Your VA Loan – a $25 Value.

If you’re just beginning to explore future plans to buy a home…that’s OK. Take the first “baby step” now and get our most valuable “early preparation” education & training guides in one easy request! The training guides come with The Plan! Get The Plan or call!

- Top 5 Mistakes VA Home Buyers Make – Quickly and Easily Take Action Steps to Get Well Prepared! Don’t just survive the home buying process using your VA loan…Crush it! THRIVE!

- Copy of Amazon’s #1 VA Book: Avoiding Mistakes & CRUSHING Your Deals Using Your VA Loan – a $25 Value.

- Ongoing email education, market updates & more tips!

Using The Plan Can Bring Success

When you take this small step today by getting The Plan, there’s a strong chance you’ll get results like Staff Sgt. Matt Rohnert (U.S.M.C) and his wife Kathy (and their new son Wayne). Matt & Kathy were referred by U.S.M.C. GySgt (Ret.) Lewis Zepeda who successfully utilized our Dreamweaver Home Purchase Process for his family.

Matt & Kathy didn’t hesitate after meeting us at an event at Legacy Brewing on October 23rd. They got a copy of The Plan, committed to our process and utilized our Veteran’s Angel Program to Get The Seller to Say Yes. They had their son, Wayne, on December 29th, closed on January 5th, and moved into a beautiful home on a quiet street in Temecula…right before rates went up about ¾ of a percent! Matt didn’t wait but a few days before he texted me this message and picture, “Of course the first thing I do is FLY this BEAUTY high and PROUD!”

Hesitating or Disregarding The Plan Can Result in Frustration & Defeat

Contrast the Rohnert’s story with Amy and her husband. (I’ve left out her last name because I don’t want to “call her out,” but it’s an important lesson.) I also met these two at one of my “Brewery Events” at Legacy Brewing Co. in Oceanside. Amy initially showed signs of doubt and hesitation regarding connecting with us.

In her online RSVP to the event, she entered a wrong phone number. They did attend the event. When speaking with her at Legacy, she told me their story of working with one agent, being unhappy and then finding another agent. She described each failed attempt to buy over the previous months. At the time, she had two VA offers submitted.

Without a correct phone number to use, we emailed her a few times to follow up; we received no reply. Later, she reached out to me through Linked IN! I replied, asking her to call our office. She called, spoke with us and said that neither of their two VA offers had been accepted. She seems to be warming up to The Plan. But what “price” has she and her husband “paid” in the meantime?

The Story of Defeat Can Start Here and Looks Like This…

- Amy and her husband are unfortunately living through a common story of VA home buyer’s failure. This is their storyline…and an example of what not to do…

- Engage the market with agents who may not demonstrate a concrete commitment to your success and who are utilizing typical methods. They do not have our programs.

- Experience extended periods of repetitive, unsuccessful VA offers resulting in increasing amounts of frustration and VA home buyer’s “battle fatigue.”

- Home prices continue to rise.

- Interest rates continue to rise.

- Your landlord continues to raise your rent.

The stakes are high for you and your family. If you are considering buying a home using your VA loan, but you think I’m making all this up, just ask at least five friends (who have served) this question, “Hey friend, have you or anyone you know ever had challenges using your VA loan, when buying a home?” When I ask this question at my VA home buyer events, (often held at a local brewery), sometimes as many as 70% of the attendees raise their hands high and say, “Yes.”

How Does it FEEL to be a Homeowner with Your VA?

Ask just about anyone how they feel as a HOMEOWNER. Recently, I came back from a week-long trip away. It was late at night, and I was alone coming home. When I walked through the door from the garage, the house was dark. Entering the kitchen, then the living room, I turned on the lights. When I put down my luggage, I felt this unique moment of gratefulness…I felt a tiny touch of status…I felt pride…it felt surprisingly comfortable…I felt that presence of family & love…it was all warmly wrapped up in one subtle slice of time…I’ll never forget that moment. It was special.

I know Kathy and Matt are having those same feelings. WHY? Because when I went to their house warming party, Kathy’s influence on their home…her décor, the pictures, the way she talked about the rooms and spaces when she gave me the tour…Kathy had “set the mood” in her new household. Everything I witnessed illustrated her and Matt’s sense of happiness, pride and family…and security.

It was pretty clear to me that this new residence…their HOME…was the key ingredient that made their growing family COMPLETE.

Staff Sergeant Rohnert and his wife had now become Matt & Kathy Rohnert, loving parents of Wayne…proud homeowners of a beautiful home in a quiet community…and viewed by family, friends and their peers with a greater sense reverence and respect.

Service members buying homes…it’s the ultimate statement & and punctuation mark to being an American…to American values.

You’re still reading, so you want to buy a home, but maybe you believe that all you need is a mortgage lender to provide a VA loan or a Realtor to help you get into the house. Yes. Upping your game by having specialists on your team who have expertise in working with VA loans and VA home buyers will certainly offer an advantage…yeah, GREAT PEOPLE will increase your probability for success…but our clients tell us that even working with “those specialists” was often not enough to achieve success.

You’ll give yourself and your family a much greater opportunity for success (and avoid frustration and defeat) by getting The Plan and committing to our process which will utilize one of:

3 Breakthrough Programs to Transform Your Home Buying Experience and Result

This is where PASSION meets INNOVATION.

For the moment, we are going to put the idea of buying a piece of land and constructing a home from scratch – a worthy goal – aside and discuss it later. Why? Because our 100% VA Construction Loan is possible, but achieving success requires overcoming many significant challenges. The effort also requires time and resources from you that most of our clients prefer not to commit to.

So let me tell you about an idea I had in the summer of 2011. It was an AH HA MOMENT! This bold, entrepreneurial innovation became our flagship program: “The Dreamweaver.” Our exclusive Dreamweaver Home Purchase ProcessTM delivers you a FULLY CUSTOM RENOVATED HOME for ZERO down and ZERO out of pocket closing costs. It is the ULTIMATE SOLUTION to Getting the Seller to Say Yes, because I’m the seller! And of course I want to say yes to YOU! Here’s how it works:

We’ll help you find an ideal home that will look significantly more appealing when it is updated and improved. The chosen property must represent an opportunity to add value when the renovations are completed. Fixer-uppers are ideal.

We will then make a CASH offer (which sellers prefer), and that CASH offer will dramatically improve the probability of securing a purchase contract and acquiring the home at the desired price. Yes! We use our cash for YOUR benefit! We’ll establish a budget and renovate the home to your specifications. Just imagine…you get to choose your kitchen cabinets, your countertops, your flooring, your fixtures, your appliances, your paint colors… nearly everything!

Then we transfer (sell) the home to you, using your VA loan, for zero down and zero closing. Many, many clients before you have been skeptical, thinking this “sounds too good to be true.”

This Sounds Way Too Good to Be True…

I get it…it’s in everyone’s nature to be skeptical, and your military training may have told you to keep your guard UP. No problem. We’re an open book…totally transparent…with nothing to hide & no tricks up our sleeves.

Really…if we were trying to deceive Veterans, that would eventually be business suicide, wouldn’t it? Someone would figure out the scam, and the resulting whiplash would devastate me, my family and my employees – not a game I want to play. For a more comprehensive description of “The Dreamweaver” and details of how we earn income and manage the all the risks, click here.

It’s NOT too good to be true. Just watch the videos & ask our clients. Would you like their phone numbers? No problem. Don’t you think they are excited to share their stories, given their results? Damn right they are…call ‘em!

Why Are We Doing This?

Why Would We Take Such Risks?

What’s The Catch?

Are We making a Fortune?

Let’s answer that last question first. No, we are not making a fortune. This isn’t like HGTV or Bravo TV where we’re “house flippers” trying to make huge profits on Veterans! We would get “chewed up and spit out in little pieces,” and then run out of town in a New York minute, if that were the case!

As real estate investors, we anticipate that when the renovations are completed, you’ll quickly buy the property from us, without us paying real estate commissions. This eliminates marketing time frames altogether, thereby increasing our speed from purchase to sale and lowering sales costs. This allows us to reduce our risk. We pass that onto you by reducing our expected profit margins and earning moderate sums when we buy and sell.

Some who learn of this model from a real estate investor’s perspective think it’s brilliant. The realities from an investor’s standpoint are far from sexy. It’s still a risky business with many uncertain moving parts, but I think I can manage it well enough…to JUST make it worth it…for all parties, especially YOU.

We are completely transparent with regard to how we transact on all of our programs, especially with our Dreamweaver Home Purchase ProcessTM. With The Dreamweaver, you’ll have your hands on all the numbers. We disclose everything. WE HAVE TO BE transparent, when we are making such large promises to you. If just one client discovered something we were hiding, it would sink us – permanently. We’re an open book.

Here’s How We Earn Our Income and How The VA Protects You

The Dreamweaver Home Purchase Process has the potential to generate three sources of possible income to us: a commission on the real estate purchase, a moderate profit margin on our investment capital, when we sell the home to you, and we earn income from the loan.

As you can see, we are performing multiple services simultaneously and earning income in traditional manners, as other do in the same way. When clients speak to us personally and take a good hard look, understanding what we do and the risks we take, our clients are always satisfied with our answers to their direct questions.

By the way, the VA protects you from paying too much for the home by way of the independent VA appraisal. We can’t get 100% VA financing on your VA loan for more than the home’s VA appraised value. Again, watch our client’s Dreamweaver videos, especially Vince and Erica’s video.

And our interest rates? Our rates have to be highly competitive, or our clients would by and large be unhappy. But they are very happy! Again, watch the videos! Call them if you want; they would be more than willing to chat.

Really Peter…Why Are You Doing This?

Again, my name is Peter Van Brady. I didn’t serve. I wasn’t born a patriot – far from it. I’m embarrassed to say that in 1981 I was frightened of the Selective Service Act – the daft, as I came of age. I had no desire to serve my country. I could never have imagined myself like this…in THIS spot that I find myself in today. It’s very hard to put in words…buy I’ll try…

…now…this “place where I am coming from today,” it’s just a feeling…but where did it come from? For any of us to get from our beginnings to here…where we are today, we just have to connect the dots…from one to the next, right? As adults we make a series of choicesover time that define who we are…who we have become…and how we feel about it.There is a famous song lyric, “How did I get here?”

Fast forward through my life’s story…meeting Nancy at UCSB, two incredible daughters, one amazing son (who has autism), a life of adventure and entrepreneurial successes (and defeats), three current businesses…which now all work together to provide me the hope and opportunity to help Veterans.

I gradually got PULLED in…drawn further and further into this love affair – working with active military and Veterans. The more I got to know our clients, many who have made significant sacrifices for our country, the further I was drawn in. Frankly, I am still awed and made to feel small and insignificant by the selfless men and woman who serve – out of duty – not even knowing me or the other 300 million of us. I am simply perpetually drawn into the life stories of the truly humble personalities that make up our military – our client base.

And then there are the non-fiction stories…the books…the true accounts of men and women who have given EVERYTHING.

I have read (and listened to) so many documented reports of commitment, sacrifice, duty…real accounts of the chaos and heartbreak of battle…it all just makes me feel so irrelevant. It really does…just tiny.

So…it is an HONOR and a PRIVILEGE to be given the opportunity to workwith you. I now choose to only work with those who serve.I prefer to be doing (in my opinion) exceptional things…things that no one else wants to do or is able to do.

I prefer to be applying my passions and innovations to produce one of a kind, incomparable results for you. It feels sort of like…I’m exercising all my creativity and entrepreneurial spirit to be able to give back…to give to those who chose to serve, because they did so mostly out of duty and brotherhood…I get to give to you…it feels good. To give is good. Perhaps, it even took me a lifetime to learn that.

This endeavor is a worthy effort. I believe this market is “underserved” and will benefit from my innovations. This work gives me and my team purpose. It’s just slightly less difficult to brush off the inevitable business disappointments, when we are driven by this cause to serve you.It’s a whole lot easier to “go the extra mile” for those who (chose to) serve.

Does that answer the question of WHY I am doing this? I sincerely hope we get a chance to meet.

Choose the Plan, Not The Program

Together, when we begin your search for the right home for you…where you want it, just the way you want it…you don’t choose one of our programs and then try and find the home. Just the opposite. We have your needs, wants and dreams in mind as we scour all our many property sources for the right piece of real estate for you – the right opportunity.

What if we find a home that’s already nearly perfect? What if this discovery is everything you and your family are looking for? We can’t make a cash offer because the property is already modern and up to date. There doesn’t exist a “value add” opportunity for renovation.We must make a VA offer. In this case, we deploy our “Stealth Tactics.” We utilize our…

Veteran’s Angel Program

Our most POWERFUL tacticdeployedin our Veteran’s Angel Program is very “stealth-like.” This is the third of three tactics, and it is invisible to The Seller…THIS TACTIC is utilized as the ultimate lever that we reach up to, grab it with both hands and pull it down hard, locking in the purchase contract and the whole transaction firmly into place.

As you will soon see, the first two tactics of the Veteran’s Angel offensive attack open the door and engage The Seller…breaking down his or her defense mechanisms. The third and final invisible tactic drops a ton of weight on the tipping scale, as The Seller surrenders and says,”YES” signing the residential purchase agreement in acceptance of your VA offer. Congratulations. The Seller is now under contract to allow you to buy the home you really want.

Frankly, we can’t share ALL of these tactics to the open public. They are trade secrets. However, we will allow you to discover some of our secrets on the next page! When you become an approved client, and we have established a mutual trust, we will share EVERYTHING with you under the strictest of confidence.

If we were to openly advertise all of these tactics, it would ultimately deplete their effectiveness over time as listing agents and sellers figure it out. For your benefit and every client after you, we can’t take that risk

Discover a little more about our Veteran’s Angel Program.

My Promises – My Guarantees to You

I challenge you right now to take the first small step now to begin your journey to getting the home you really want. I pledge many promises and make many Guarantees to you:Request a copy of The Plan to “Get The Seller to Say Yes” now, andhere’s what you will receive in The Plan:

- Our simple and easy 3 step process: Start by receiving The Plan today and finishing by Getting the Seller to Say Yes and moving into the home you really want!

- Our SoCalVAHomes Value Guarantees – Our Core Values & ironclad promises to you!

- Your “Needs & Wants Wish List”: We’re listening…tell us EXACTLY what you need & want in your new home – everything!

- VA Home Buyer’s document checklist: These are the items you’ll need to share with us to achieve your VA Loan Pre-Approval!

- A “one-on-one” phone (or in person) consultation: An in-depth education about how we use the strategies, tactics & trade secrets of The Dreamweaver Home Purchase Process and The Veteran’s Angel Program to transform your home buying experience and result.

- Top 5 Mistakes VA Home Buyers Make – Quickly and Easily Take Action Steps to Get Well-Prepared! Don’t just survive the home buying process using your VA loan…Crush it! THRIVE!

- Copy of Amazon’s #1 VA Book: Avoiding Mistakes & CRUSHING Your Deals Using Your VA Loan – a $25 Value.

I GUARANTEE YOU that we will listen closely to your goals and desires – to what you are trying to accomplish. Your home ownership goals are our first priority.

I GUARANTEE our team of expert’s intense devotion to YOUR home ownership goals, using one of our 3 breakthrough programs can deliver a SUPERIOR RESULT when buying your next home.

Call one of our Client Service Specialists now to begin the conversation with us and get a your copy of The Plan (949) 268-7742

Thank You

Thank you for your service. And I don’t take the extension of that gratitude lightly. I truly mean that!